By Scott Hamilton

Wouldn’t it be nice if everyone were honest all the time? Yeah, it would be nice, but that’s not how the cyber world works (or the real world!). Unfortunately, cyber criminals are lurking around every corner of the internet looking for the right opportunity to steal your online account data.

Sounds scary, right? It can be. Unless you use a password manager.

To help keep your online accounts as secure as possible, we’ve boiled down all the information we could find about password managers—for all flavors of computers and mobile devices—and have provided everything you need to know below.

Table of Contents

Why You Need a Password Manager

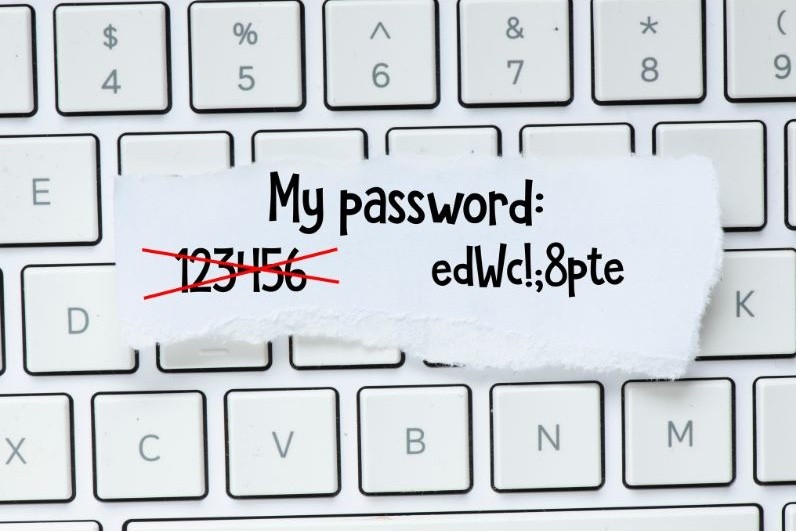

Too many internet users create their passwords using easy-to-remember names and dates (e.g., birthdays, addresses, last names). Or they use the same password for every one of their online accounts. Some people even write their passwords on sticky notes.

Don’t do this!

You’re leaving yourself wide open to cyber attacks. Once a cyber thief figures out your password on one website, they can use the same password to gain access to more valuable information (like your financial accounts!).

Be smart. Use a password manager instead.

Password managers work by encrypting your passwords and storing them in a secure database that’s easily accessible by you—and you only. You can access your passwords from anywhere, with any type of device, by logging in to your password manager account with a master password that you create.

Note: Make sure you create and remember a super-strong master password. The master password gives you access to all your other passwords stored in your password manager.

How to Pick the Right Password Manager

There are a ton of password managers out there. We put together a list of considerations to make sure you pick one that’s just right for you.

- Password generation: Most password generators can create strong, unique passwords for all your accounts for you, so you don’t have to come up with a password for every single one of your accounts.

- Autofill login: Most password managers automatically fill in your data on web forms via a browser extension or smartphone app. Aside from the convenience, especially if you’re an online shopper, this is particularly useful because it encourages you to avoid using the same password over and over again.

- Password sharing: You might want a password manager that lets you share your online account login details with a family member or friend of your choosing.

- Password auditing: Some password managers can audit your passwords and tell you which ones are weak or a duplicate of another password.

- Two-factor authentication (2FA): 2FA means your accounts are twice as secure. Some password generators support this functionality.

- Dark web monitoring: Some password managers can monitor the dark web and tell you if any of your passwords are being compromised.

- Mobile device support: You might want a password manager with full support for mobile devices (including iPhones and Android cell phones). Before committing, make sure the password manager you pick works on all your devices.

- Ease of use: The last thing you want is to struggle navigating another complicated interface.

- Cost: There are free password managers out there, but the free ones don’t usually offer all the features listed above.

Here’s a short list of the most popular password managers:

Be Smart

If you’re tired of forgetting your passwords or worrying about them being abused by cyber criminals, we highly recommend using a password manager. It’s one of the smartest things you can do to protect your online accounts and your personal information.

If you’d like any help, don’t hesitate to reach out for assistance. The Hamilton Financial Planning team is here to help you feel confident that your information and your financial future are safe.

Schedule a complimentary get-acquainted meeting online or reach out to us at 512-261-0808 or scott@hamiltonfinancialplanning.com.

About Scott

Scott Hamilton is founder and chief financial officer at Hamilton Financial Planning, a wealth management firm that specializes in providing comprehensive financial planning for retirees. With over 20 years of experience in the financial industry and having completed over 250 financial plans for retirees across all industries, but mostly the oil and gas industry, Scott is passionate about providing his clients with the tools and insight they need to achieve their financial goals. He has a Bachelor of Business Administration in finance from Texas State University and an MBA in international finance from Pepperdine University. Scott has also been happily married to his wife, Gayle, for over 25 years. To learn more about Scott, connect with him on LinkedIn.