Our Services & Fees

Fee-Only, Fiduciary, Independent Financial Planning in Austin & Houston

Financial Planning

With our fee-only hourly financial planning, our goal is to educate you on your options so you can make empowered decisions with your wealth. Depending on your needs, your plan may narrow in on one element or address multiple goals you’d like to achieve over time. Whatever you choose to focus on, your financial plan is designed to serve as your road map, helping you navigate whatever comes your way.

Our hourly financial planning services can tackle concerns you have, such as:

- Cash flow planning

- Education planning

- Estate planning

- Retirement planning

- Risk management

- Tax planning

With our fee-only hourly financial planning, you know exactly how much you’re paying and the price depends on the complexity of your financial situation. It typically ranges between $3,500-$5,500 and can be paid directly with a credit card or ACH transfer.

Cash Flow Planning

Education Planning

Estate Planning

Retirement Planning

Risk Management

Tax Planning

Fee-Only Investment Management

With our full-service wealth management program, we create an enduring relationship where we assist our clients with ongoing wealth management and financial planning. We work with you for the long term to build comprehensive strategies catered to you to help achieve your long-term financial goals. These wealth management services might include:

Comprehensive Investment Management

Account opening, transfers, money moves,

Regular rebalancing and cost reduction strategies

Model allocations based on risk tolerance and risk capacity

Tax and Charitable strategies to reduce to the long-term tax burden

Minimum quarterly charge is $500

Investment management fees are deducted from the investment accounts quarerly.

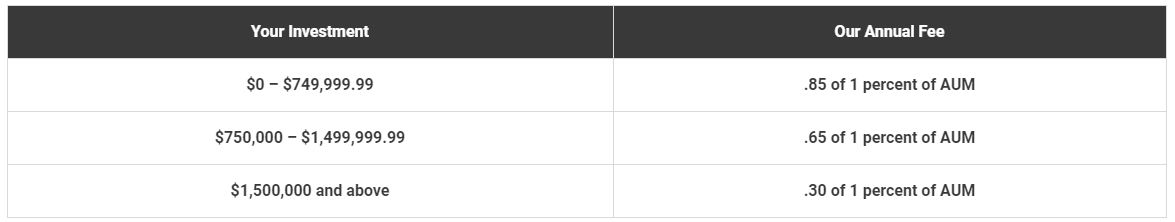

Asset Under Management fee ranges from .85% down to .30% annually.

Non-Traditional Retirement

55-Year-old, Baby Boom, married with 2 kids in college. Interested in a financial plan to help them plan for an early retirement once the kids have completed college. This couple has a large home, plans to downsize when the kids graduate from college and then move to a smaller, single story home. A non-traditional retirement is an option – starting a second career or step-down job. This would provide a challenge and income for the pre-retirement years.

Retiring with Uncertainty

60-Year-old, Employee in the Oil & Gas field, planning to retire, but worried about the future of the Energy business. Needs financial planning to confirm readiness for retirement. Worried if they have enough money saved, if the spending plan works. Concerned about the unknowns (health care, medical issues, or maybe if they will need to work during retirement.) The financial planning process helps this client to have financial piece.

Financial Optimization

65-Year-old, Married, 2 kids. Worked for 30 years and now is ready to retire or retired. They have a mostly paid for home and the kids are out of college and stabile. The client is interested in a comprehensive plan focusing on tax reduction strategies so they will pay the IRS 100% what is owned by not anymore. Also, of interest is the best solution for their charitable giving and if this can possible reduce their tax burden.

What We Charge

As a fee-only financial planning firm, we never earn a commission. We never act as salespeople and we’ll never hide how much our services are going to cost you. There are no other hidden costs and we’re not compensated through things like revenue sharing, commissions, sales loads, or sales contests. This means we’re paid for our unbiased advice only, and aligns our compensation with your best interests.

For our Hourly Planning clients we charge by the hour with the cost typically ranging between $3,500-$5,500.

If you are a Wealth Management client, we are compensated by an Assets Under Management (AUM) fee, which is paid quarterly, based on the value of your assets we manage. We have NO minimum asset requirements, however, we do have a minimum quarterly fee of $500.