Who We Are

As an independent fee-only fiduciary financial advisor with offices in Austin and Houston, we help Texans reduce taxes during retirement. We simply optimize the tax strategy and implement a comprehensive wealth management process. The foundation is built on an honest, trusting relationship that is both transparent and responsive.

Financial Planning Overview

“If you don’t know where you are going, you’ll end up someplace else.” Yogi Berra

Everyone needs a comprehensive financial plan to map their future. We are planning driven and planning is the foundation of any investment strategy.

The financial planning process is broken into 3 phases.

The Financial Planning Process

Built on collaboration.

Here’s a brief overview of the steps you can expect when you work with us:

Phase 1: Quantify Goals

In order to effectively advise you on important financial decisions, we need to determine the frequency, duration and amount tied to each goal. Some examples include:

How much you spend on your car (maintenance, insurance, etc.)

How long you drive your car (one year, five years, etc.)

How often you replace your car

Phase 2: Define Facts

In the beginning of our relationship, we’ll create your net worth statement: a comprehensive listing of all your assets and liabilities. This statement will serve as the foundation of your financial plan.

Phase 3: Build Model

A collaborative and interactive process, this phase involves a deep discovery into your wealth’s ultimate potential. As your personal and professional affairs evolve, we will revisit our recommendations and make adjustments as needed to help make sure your plan is optimized at all times. See a full sample financial plan here.

What You Can Expect

At Hamilton Financial Planning, we pride ourselves on being:

Fiducially honest

Brutally Transparent

Refreshingly affordable

Why We Use Dimensional Fund Advisors (DFA)?

We use DFA because they take a less subjective, more systematic approach to investing. By drawing information about the market’s expected returns, DFA allows markets to do what they do best — drive information into prices — thus giving DFA more opportunities to capitalize on where they have an advantage. DFA’s core strength: their academic orientation, which helps them remain focused on the objective at hand.

What Sets Dimensional Fund Advisors (DFA) Apart?

Proven Investment Performance

Time-Tested Strategies

Unparalleled Risk Management

Based on broad diversification, mitigating risks such as holding too few securities or betting heavily on specific industries.

Efficient Trading

Meet the People of Dimensional Fund Advisors (DFA)

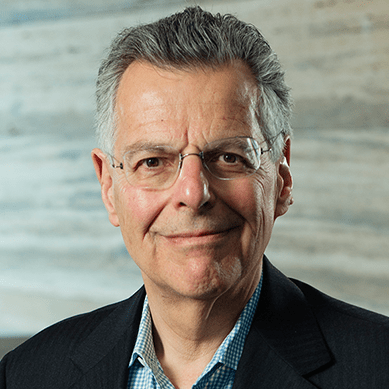

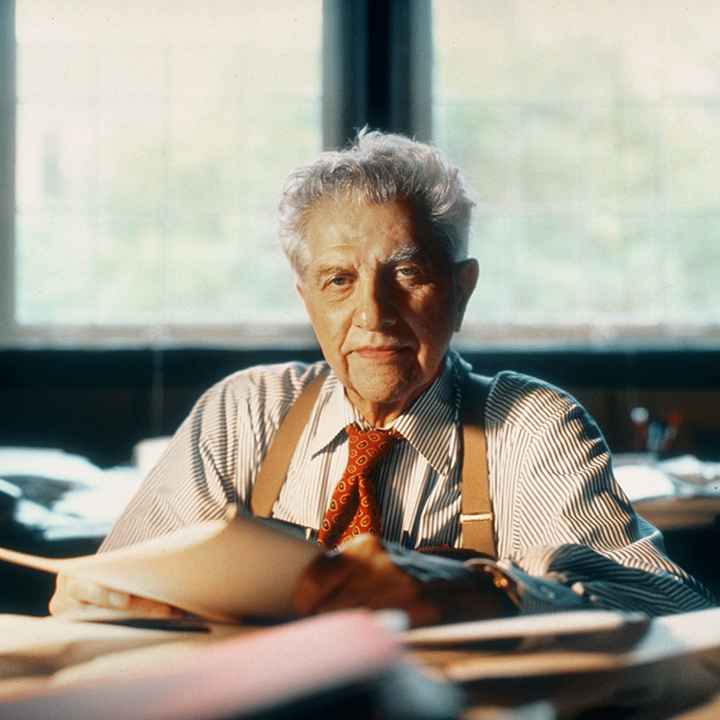

David Booth

Founder, and University of Chicago alumni

Robert Merton

Nobel Laureate 1977

Eugene Fama

Nobel Laureate 2013

Myron Scholes

Nobel Laureate 1997

Merton Miller

Nobel Laureate 1990

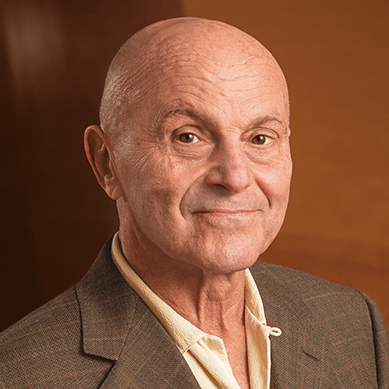

Founder and Financial Advisor

Scott Hamilton, CFP ®

Founder & Chief Financial Officer

With over two decades of financial management experience, I’ve worked at innovative startups, as well as Fortune 500 companies such as Exxon and Dell, where I worked as a senior principal consultant and product manager. I am licensed to do business in Texas, Louisiana, Florida and South Carolina and have a master’s degree in international finance from Pepperdine University.

A native Texan, my experience ranges from working in the oil, gas and technology fields to managing people’s assets for over 20 years — designing more than 250 financial plans throughout my career. Decoding the many intricacies involved in the financial modeling and investment management process is what I do best: providing my clients with the tools and insight they need to achieve their financial goals.